Back

3 Tips for avoiding sales tax overpayment

Sponsored Content

For a business owner, collecting and remitting sales tax, both GST and PST, is annoying enough without discovering that you may have been inadvertently overpaying the Canada Revenue Agency (CRA).

"The overpayment of sales tax happens for a variety of reasons," says Andrew Adolph, CPA CGA and General Manager of AHS Tax Group. "It can be due to a simple clerical error, lack of knowledge, or a software error. The key is to locate the error, fix it, and claim back any overpaid tax."

Andrew offers these three simple tips to make sure the CRA doesn’t owe you a sales tax refund:

1. Review sales tax remittances for the past four years

"People often don't realize that the time limitation for claiming a refund for overpaid taxes is four years," Andrew notes. "We review your data for both GST and PST for the previous four years and then we can file a claim for anything you're due. Keep in mind that going back four years could mean a substantial recovery."

2. Pay attention to cross border transactions

"Ideally," Andrew says, "you'll be asking a GST and PST expert, such as AHS Tax Group, to help you structure your cross border transactions to make sure that you're eligible for any rebates. It's important to identify the correct legal claimant and to make sure that every transaction will stand up to CRA scrutiny."

3. Check supplier invoices for sales tax

"Overpayments can occur for a number of reasons," Andrew explains. "But the biggest cause is usually not being able to easily identify the GST amount on a supplier invoice. We’ve found that not all supplier invoices clearly show the amounts paid. This makes it difficult to identify any GST amounts that are reimbursed to employees or volunteers, for example. A GST rebate can be claimed on reimbursements. It doesn't take long for these usually small amounts to add up."

Andrew and his colleagues at AHS Tax Group have a combined history of over 75 years of working for CRA.

"We're sales tax specialists," Andrew says. "We can come in and look at your data and we can tell if there's overpaid sales tax there. If we don't find anything, you don't pay anything."

For more information about AHS Tax Group and their sales tax services, call 604.200.5418, email andrew@AHStaxgroup.ca, or visit the website. AHS Tax Group can also be found on Facebook and Twitter.

By: Delta Optimist

GuidedBy is a community builder and part of the Glacier Media news network. This article originally appeared on a Glacier Media publication.

Location

Topics

Related Stories

-

Finance Richmond

Column: Buy travel medical insurance, trust me

Paradise doesn't always look the way you expect it to. My husband Harvey and I were just looking for sun, sand and lots of...

-

Finance

It's never too early to help youngsters make sense of cents

It’s September and that means back to school! School often starts at home and having a discussion about basic financial...

-

Finance Burnaby

Profiles of Excellence: Harjit Sandhu at IG Wealth Management

Sponsored Content There’s no such thing as one-size-fits-all when it comes to money – yet all too often, financial advice can...

-

Finance Vancouver

A ‘financial spa’ has opened in Vancouver

One thing is for sure, a new financial institution in Kerrisdale is not your grandmother’s bank. To find out more about this...

-

Finance Burnaby

Profiles of Excellence: Custom Mortgages

Sponsored Content The hunt for a dream home is often focused on the physical: the type of house, the number of rooms, the...

-

Finance Burnaby

Power up your future with compound interest

Sponsored Content Is compound interest the eighth wonder of the world? According to Albert Einstein, who knew much about...

-

Finance

MONEY MATTERS: If debt’s got you down, it’s time to get your debt down

Down with debt! But what is the best way to get debt down? I just helped a friend consolidate her debts to reduce her...

-

Finance

MAKING CENTS: Ready to retire? Ask yourself these questions first

The ability to retire comfortably is all about creating enough cash flow to cover your living expenses for the lifestyle you...

-

Food & Drink Abbotsford

4 Dishes to Make with Summer Peaches

Summer is the perfect time of year to experiment with different ways to use peaches. These juicy, refreshing fruits can be...

-

Home & Garden Abbotsford

How to Create a Zero-waste Household

Reducing your household waste can help the planet in many ways. You may even be able to eliminate your waste completely if...

-

Beauty & Wellness Abbotsford

7 beauty trends for summer 2021

You may be looking forward to re-entering society this summer or at least looking better during a video meeting. Beauty trends...

-

Gifts Abbotsford

Four fabulous experience gift ideas for mom this Mother’s Day

If you’re tired of giving the same old types of Mother’s Day gifts, treat your mom with an experience instead. There are many...

-

Home Furniture & Decor Abbotsford

Working from home? 4 tips for your home office setup

Working from home can be a better experience for you with the right office setup. Setting up your in-home office correctly can...

-

Food & Drink Delta

Blog: Eating bugs can be good for you

Eating ants and other insects could soon be recommended to protect against cancer, and it is believed that us Westerners will...

-

Home Furniture & Decor Delta

It just takes a little determination to design a gallery wall

Gallery walls, also called moment walls, are one of today's hottest home decor trends. Gallery walls enable homeowners to...

-

Beauty & Wellness Delta

Dentist comes full circle, landing back in Tsawwassen

Sponsored Content “Life is what happens when you’re making other plans.” That’s what Dr. Brian Ruddy said when asked what...

-

Design & Renovations Delta

Rooms do double duty in smaller homes

Many homes do not have space for guest rooms, play areas and home theatres that are possible in homes with substantial square...

-

Dessert Delta

Blog: Mango coconut mousse

Looking for a dessert that is lactose-free and gluten-free? Try this delicious mango coconut mousse! This is a...

-

Beauty & Wellness Delta

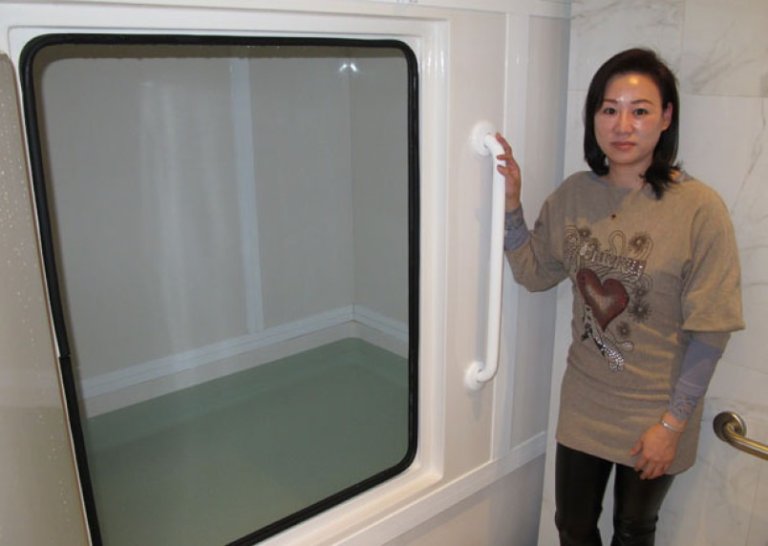

Float your stress and pain away

A sweeping trend in health and wellness has recently set up shop in South Delta. Spa Bleu opened its doors last fall on...

-

Beauty & Wellness Delta

There’s an underground society of naked sauna people traveling around B.C.

“Bring a towel.” That’s the message from the BC Mobile Sauna Society – a mobile sauna and spa society that provides saunas...

-

Christmas Delta

Secrets to a dazzling tree

While tree sellers conveniently stationed in store parking lots and artificial trees displayed in retailers have led fewer...