Back

Profiles of Excellence: Custom Mortgages

Sponsored Content

The hunt for a dream home is often focused on the physical: the type of house, the number of rooms, the neighbourhood it’s located in.

But in truth, making the right choice involves all sorts of less visible but equally critical considerations – and key among them is the mortgage.

The wrong mortgage can make the dream of home ownership into a nightmare – but the right one can be the foundation upon which the success of long-term financial success is built.

Making sure every client finds the latter is the philosophy that’s been driving Custom Mortgages since it opened its doors 10 years ago.

“Custom Mortgages was founded on the principal of helping people achieve their goal of real estate ownership in a way that helps them achieve other goals in their life as well,” said Rishel Tomlinson, principal mortgage broker with Custom. “My motto is: if you get your mortgage right, everything else becomes possible.”

For Tomlinson, that means sitting down with clients to look at goals, budgets and most importantly, cash flow, and not just figuring out the biggest possible amount a client can be approved for.

“Contrary to most mortgage application processes where the conversation begins by asking how much income is earned, at Custom Mortgages we begin the conversation by asking what type of property and location is desired, and depending on the given purchase price range for this type of product, we talk about what the individual cash flow needs are for each unique borrower, and from there provide them with their top three mortgage options and strategies to help them achieve their real estate purchase within the cash flow parameters we’ve identified.”

In other words: find success for each client by matching the right mortgage – type, conditions and size – to their actual lives, goals and financial situation.

For Tomlinson, avoiding a one-size-fits-all approach means getting to know her clients and their goals – and staying with them for the long-term.

She’s worked with countless clients through that overwhelming “first home purchase,” helping them navigate the process – but she’s also worked alongside long-time clients through multiple home sales and purchases.

“To be able to see someone achieve their goals is so rewarding,” she said. “I have heard many times: I didn’t think it would be possible, thank goodness I talked to you because having achieved this real estate ownership has made so much more in my life possible.”

For example, Tomlinson points to a client who, through several moves, went from not believing they could own a home at all, to being mortgage free.

“That’s a huge accomplishment and it’s very exciting to be part of people’s lives in that way,” she said.

As the organization reaches its 10th anniversary, they’re preparing to launch a unique app that will help people answer the question “What can I afford” which looks at not just the basics, like income level, but future plans like having children or moving to a different area.

“It’s not a simple question and the app will help make it simple by working step by step through all the factors,” she said. “It can be a very stressful process for people when it comes time to buy or sell, to apply for a new mortgage, and really at the end of the day my job is to make it straight-forward, to make it comfortable and to make it work for my client, now and into the future.”

For more information, please visit their website.

By: Burnaby Now

GuidedBy is a community builder and part of the Glacier Media news network. This article originally appeared on a Glacier Media publication.

Location

Topics

Related Stories

-

Finance Richmond

Column: Buy travel medical insurance, trust me

Paradise doesn't always look the way you expect it to. My husband Harvey and I were just looking for sun, sand and lots of...

-

Finance

It's never too early to help youngsters make sense of cents

It’s September and that means back to school! School often starts at home and having a discussion about basic financial...

-

Finance Burnaby

Profiles of Excellence: Harjit Sandhu at IG Wealth Management

Sponsored Content There’s no such thing as one-size-fits-all when it comes to money – yet all too often, financial advice can...

-

Finance Vancouver

A ‘financial spa’ has opened in Vancouver

One thing is for sure, a new financial institution in Kerrisdale is not your grandmother’s bank. To find out more about this...

-

Finance Burnaby

Power up your future with compound interest

Sponsored Content Is compound interest the eighth wonder of the world? According to Albert Einstein, who knew much about...

-

Finance

MONEY MATTERS: If debt’s got you down, it’s time to get your debt down

Down with debt! But what is the best way to get debt down? I just helped a friend consolidate her debts to reduce her...

-

Finance Delta

3 Tips for avoiding sales tax overpayment

Sponsored Content For a business owner, collecting and remitting sales tax, both GST and PST, is annoying enough without...

-

Finance

MAKING CENTS: Ready to retire? Ask yourself these questions first

The ability to retire comfortably is all about creating enough cash flow to cover your living expenses for the lifestyle you...

-

Food & Drink Abbotsford

4 Dishes to Make with Summer Peaches

Summer is the perfect time of year to experiment with different ways to use peaches. These juicy, refreshing fruits can be...

-

Home & Garden Abbotsford

How to Create a Zero-waste Household

Reducing your household waste can help the planet in many ways. You may even be able to eliminate your waste completely if...

-

Beauty & Wellness Abbotsford

7 beauty trends for summer 2021

You may be looking forward to re-entering society this summer or at least looking better during a video meeting. Beauty trends...

-

Gifts Abbotsford

Four fabulous experience gift ideas for mom this Mother’s Day

If you’re tired of giving the same old types of Mother’s Day gifts, treat your mom with an experience instead. There are many...

-

Home Furniture & Decor Abbotsford

Working from home? 4 tips for your home office setup

Working from home can be a better experience for you with the right office setup. Setting up your in-home office correctly can...

-

Home Furniture & Decor Burnaby

Create an Awesome Home Office Space on A Budget

A small home office doesn’t have to be expensive, but properly planning your space is important so it’s a place you actually...

-

Healthy Living Burnaby

Pass the Time with These 65 COVID-19 Isolation Activities

You may be trapped in your home thanks to COVID-19, but you don't need to be bored. Here are a host of ways to keep yourself...

-

Fitness Burnaby

A Spring Training Guide for New Runners

Photo: Shutterstock If you are new to running you’ll soon learn it’s more than putting one foot in front of the other....

-

Jobs & Education Burnaby

Elderly pug pilots pooch wheelchair designed at BCIT in Burnaby

Elderly canines with osteoarthritis could soon stay mobile with a dog wheelchair developed at BCIT in Burnaby. The device –...

-

Healthcare Burnaby

B.C. residents find moving home more stressful than starting a family: poll

Ahead of the what has been deemed the busiest moving day of the year, Sunday June 30, BigSteelBox has released the results of...

-

Beauty & Wellness Burnaby

BLOG: Parents, it's time to tame those tech-addicted tots

“When you were a kid, what did you do for fun?” Nature Valley posed this question to three generations of “real families” in...

-

Casual Dining Burnaby

Don't be a jerk to servers - be a good egg

Everything we do is a choice. From the moment we wake up in the morning, until the time we come to the day's end, we choose...

-

Garden & Décor Burnaby

How to garden if you don't have your own garden

Paying $160 for the year was a pretty good price for a vacation property. Only eight minutes from Ben’s downtown apartment,...

-

Beauty & Wellness Burnaby

More people are going on 'strike' against having kids. I get it

The other day, as I was scrolling through my Twitter feed, a tweet by a fellow journalist caught my eye. It read, “My husband...

-

Finance Burnaby

Profiles of Excellence: Harjit Sandhu at IG Wealth Management

Sponsored Content There’s no such thing as one-size-fits-all when it comes to money – yet all too often, financial advice can...

-

Sports & Fitness Burnaby

BLOG: Here's why our kids need more time to play

On a visit to the small Texas town of Amarillo last year, I attended the World Championship Ranch Rodeo - a global gathering of...

-

Summer Camps Burnaby

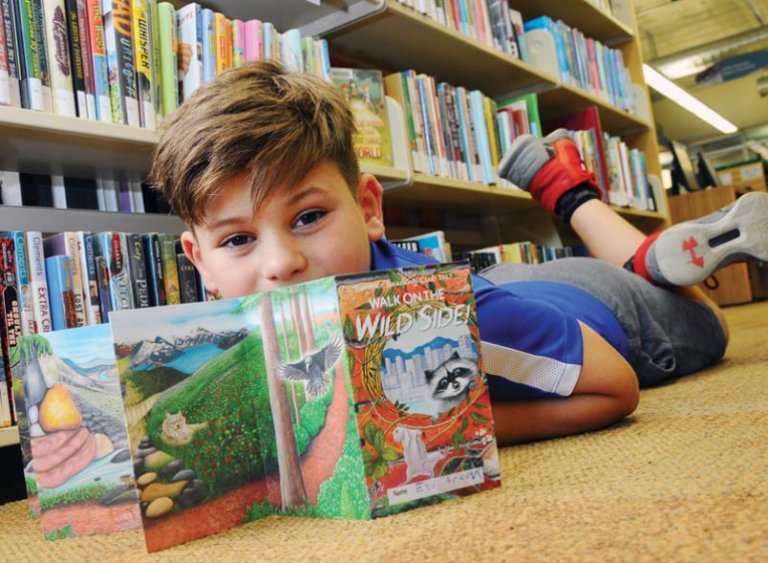

Want your child to keep their brains moving this summer? Try this

With school officially done for summer, kids ages 5-14 have the opportunity to participate in the BC Summer Reading Club - a...

-

Dessert Burnaby

This Burnaby macaron maker will steal your soul

Snoring might seem like a weird way to start a food blog about desserts, but trust me – there is a connection. See, I snore....

-

Food & Drink Burnaby

Here’s how to pair beer with food and become the hero you were destined to be

Company’s coming, dinner’s almost ready, but you forgot to pop out to the liquor store to grab a bottle of wine. Obviously, you...

-

Food & Drink Burnaby

This is the best pizza in Burnaby. I weep for those who haven't tried it

Pizza is a touchy topic. Trying to get a group of people to agree on pizza can be like pouring gasoline on a...

-

Food & Drink Burnaby

Profiles of Excellence: Atlas Steak + Fish

Sponsored Content Atlas Steak + Fish may be the crown jewel at Gateway Casinos’ Grand Villa Casino in Burnaby, but it’s only...

-

Food & Drink Burnaby

Chef Dez: You can expand your home menu without breaking the budget

Household budgets are in the news now more than ever these days and everyone seems like they’re searching for ways to tighten...

-

Animal Adoption Burnaby

Adopting a puppy shouldn't be done on a whim

Our family has adopted an eight-week-old puppy from a pet rescue - a sweet Dalmatian who had been rejected for being “too ugly”...